The banking and finance industry operates in one of the most regulated environments in the world. Every bank, insurance provider, or financial services company must ensure that employees and customers receive consistent and up to date training. From regulatory compliance to financial training programs, the demand for reliable learning management systems has grown rapidly across the financial sector.

An LMS for banking and financial services is more than just a tool to deliver lessons. It helps financial institutionscreate courses, track learner progress, and certify employees on critical areas like risk management, data security, and regulatory training. For banks, it also enables smoother onboarding of new hires, ensures compliance requirements are met, and supports customer education by building interactive courses that explain complex financial products.

By using WordPress as the foundation, financial organizations can access the best learning management system pluginsand build a scalable, secure, and user friendly learning platform. With features like compliance tracking, personalized learning paths, advanced reporting, and mobile learning, banks and other players in the finance industry can deliver an engaging experience to both employees and clients.

In this guide, we explore how to build a powerful banking LMS on WordPress, highlight the essential features you need, and share practical steps to launch a secure and professional training process for the banking sector.

Understanding the Role of LMS in Banking and Finance

In the banking and finance industry, every detail matters. A small mistake can lead to penalties, loss of reputation, or even legal consequences. This is why financial institutions rely heavily on structured training programs to keep employees updated and compliant with industry rules. A modern learning management system makes this process simpler, faster, and more reliable.

For employees, an LMS platform ensures consistent employee training across global teams. Bank employees can access learning programs that cover everything from handling customer accounts to understanding complex financial instruments. With personalized learning paths, each staff member can focus on the knowledge required for their specific job role, leading to better performance and reduced risks of costly mistakes.

For management, the role of an LMS goes beyond training. It offers compliance tracking and comprehensive reporting to prove that all employees have completed required regulatory training. Detailed reports and audit trails help demonstrate adherence to strict laws, making it easier to face external audits and inspections.

For customers, banks can use customer education modules built within the learning platform to simplify complex topics like digital banking security, loan products, or investment planning. These engaging learning experiences build trust while also empowering clients with financial literacy.

In short, the role of an LMS in the financial services sector is to deliver compliance, support corporate training, and improve both employee skills and customer knowledge. By integrating blended learning methods, including interactive courses, discussion forums, and assessment options, banks can meet modern learning needs while preparing for the future.

Ready to Build Your Banking LMS?

Seahawk’s expert team specializes in secure, scalable, and compliance-ready LMS solutions for the banking and financial sector.

Why Choose WordPress for a Financial LMS

When it comes to building an LMS for banking and financial services, security, flexibility, and scalability are the top priorities. This is where WordPress stands out as the most reliable foundation. Being open source, it allows financial institutions to customize their learning management system according to unique training needs while maintaining strong data security.

WordPress offers a wide choice of powerful LMS plugins designed for the banking industry. Tools like LearnDash LMS and Academy LMS Pro provide advanced features tailored for compliance training, corporate training, and customer education. With these plugins, banks can create courses, manage learning paths, and deliver regulatory training efficiently.

- LearnDash LMS is trusted worldwide for enterprise-level financial training. It supports role based access control, detailed reports, and advanced reporting capabilities, which are crucial for banks dealing with compliance requirements and risk management.

- Academy LMS Pro offers a modern interface with built in authoring tools, gamification, and mobile compatibility, making it ideal for creating engaging learning experiences for both employees and customers.

In addition, WordPress integrates seamlessly with hosting solutions, CRMs, and secure payment gateways, ensuring banks can manage everything from training process to certifications within one platform. The availability of cloud based LMS setups also makes it easier for banks to train global teams with consistent learning standards.

By choosing WordPress along with plugins like LearnDash LMS or Academy LMS Pro, financial organizations can build a good LMS platform that is cost effective, customizable, and ready to meet the strict demands of the finance industry.

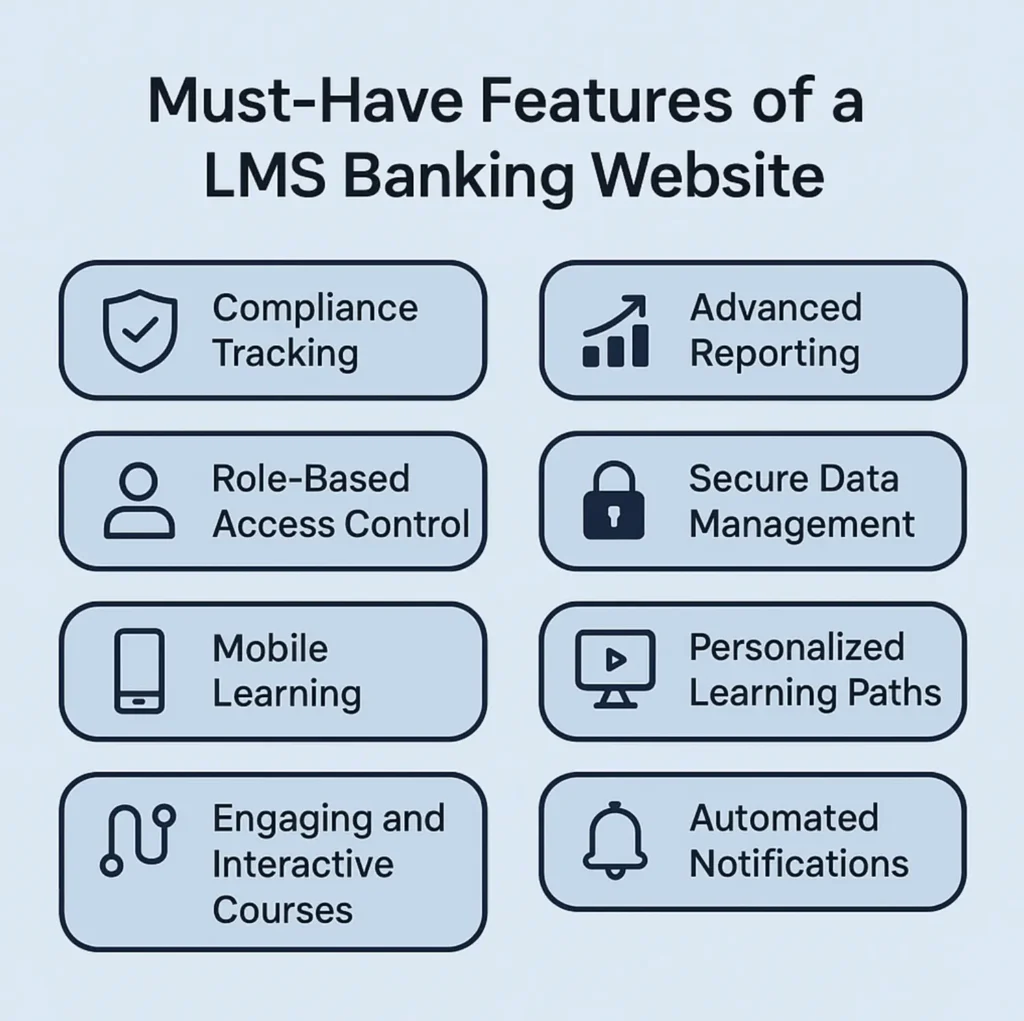

Must-Have Features of a LMS Banking Website

A successful LMS for banking is not just about uploading e learning content. It must align with strict compliance requirements, protect sensitive data, and provide tools that deliver effective training programs for both employees and customers. Below are the essential features every financial institution should look for when building an LMS on WordPress.

Compliance Tracking and Certification

In the banking sector, meeting regulatory compliance is non negotiable. Your LMS should include compliance tracking to ensure all employees complete required courses on topics like AML, KYC, and data privacy. Automated certifications help prove readiness during audits.

Advanced Reporting and Analytics

Banks need detailed reports and reporting capabilities to measure how well employees are progressing. Comprehensive reporting allows managers to identify skill gaps, track regulatory completion, and monitor learning outcomes in real time.

Role Based Access Control

Different roles in a bank require different levels of access. A good LMS offers role based access control so that administrators, trainers, and learners each see only the information relevant to their job role.

Secure Data Management

With sensitive financial information involved, data security becomes a top priority. Features like encrypted connections, audit trails, and performance management dashboards help maintain trust while meeting industry standards.

Mobile Learning and Global Accessibility

Modern banks have global teams and employees on the move. Mobile compatibility ensures that staff can access training anytime, anywhere, making the learning platform flexible and inclusive.

Personalized Learning Paths

Employees in the finance industry have varied learning needs. Some may need training on customer interaction, while others focus on risk management or advanced products. Personalized learning paths ensure that each learner gets the right courses for their growth.

Engaging and Interactive Courses

A customizable LMS should include tools to build interactive courses with quizzes, discussion forums, and gamification. These features make learning more enjoyable and improve retention rates.

Automated Notifications and Reminders

Banks often need to keep staff up to date with changing rules. Automated notifications remind learners of pending training programs, renewal of certifications, or updates in compliance modules.

By combining these advanced features in a cloud based LMS, financial institutions can deliver engaging learning experiences that are secure, measurable, and perfectly suited for the high standards of the banking and finance industry.

Best WordPress LMS Plugins for Banking and Financial Services

One of the biggest strengths of WordPress is the wide choice of plugins that can transform it into a full-fledged learning platform. For the banking and finance industry, two plugins stand out as powerful solutions: LearnDash LMS and Academy LMS Pro. Both offer advanced features, flexibility, and strong support for compliance training.

LearnDash LMS

LearnDash is often called the best learning management system for professional and corporate training. It is widely used by enterprises, universities, and even financial organizations that need strict compliance control.

- Strengths for banks: Supports role based access control, detailed compliance tracking, and comprehensive reporting. Perfect for delivering compliance modules like AML or GDPR.

- Interactive courses: Built in tools to create quizzes, certificates, and discussion forums.

- Reporting capabilities: Managers can access real time data and generate detailed reports on course completion.

- Why banks choose it: A reliable option for employee training where audit readiness and regulatory training are critical.

Academy LMS Pro

Academy LMS Pro is a modern, user friendly plugin that focuses on learner engagement and flexibility. It is a great choice for banks that want to combine compliance training with engaging learning experiences.

- Strengths for banks: Built in authoring tools for course creation, gamification, and easy customization.

- Mobile compatibility: Enables mobile learning for global teams and bank employees who need access on the go.

- Personalized learning paths: Supports adaptive modules and personalized learning experiences.

- Why banks choose it: Ideal for customer education and service training, where user experience and flexibility matter as much as compliance.

Plugin Comparison for the Financial Sector

| Feature | LearnDash LMS | Academy LMS Pro |

|---|---|---|

| Compliance Tracking | ✔ Strong | ✔ Moderate |

| Reporting Capabilities | ✔ Advanced | ✔ Standard |

| Course Authoring | ✔ Add ons | ✔ Built in |

| Mobile Learning | ✔ Yes | ✔ Yes |

| Personalized Learning Paths | ✔ Yes | ✔ Yes with gamification |

| Best Use Case | Employee compliance and financial training | Customer education and service training |

Both plugins are good LMS platforms for banks, but the choice depends on the training process you want to prioritize. If your focus is strict compliance and internal employee training, LearnDash is the right LMS. If your goal is to offer interactive courses and boost customer literacy, Academy LMS Pro is a strong alternative.

Designing a Secure and Professional LMS Website

A banking LMS must do more than deliver courses. It has to inspire trust, reflect professionalism, and safeguard sensitive information. When building your learning management system on WordPress, design and security go hand in hand.

Choose a Financial Grade Theme

Start with a professional theme that suits the banking and finance industry. A well structured layout helps learners navigate courses easily and ensures a smooth training process. Many customizable LMS themes offer built in design options that match the needs of financial services companies.

Build Trust with Branding and Visuals

In the financial sector, credibility is everything. Adding elements like certifications, partner logos, and case studies reinforces trust. Strong branding also ensures learners feel confident while engaging in learning programs.

Prioritize Data Security

Since financial organizations handle sensitive data, a secure setup is non negotiable. Features like SSL certificates, firewalls, and encrypted connections must be included. Many plugins also support audit trails and performance management dashboards to maintain transparency and compliance requirements.

Ensure Mobile Compatibility

Today’s workforce is mobile. By ensuring mobile learning, banks make it possible for employees and customers to access courses anytime and anywhere. Responsive design improves engagement and supports personalized learning experiences for bank employees and global teams.

Focus on User Experience

A clutter free interface is key to an engaging learning experience. Easy navigation, clear course structures, and automated notifications guide learners through the training process without confusion.

By designing a site that combines data security, professional branding, and user centric features, banks can offer a learning platform that strengthens both trust and compliance while meeting modern training needs.

Step by Step Guide to Building Your Banking LMS on WordPress

Creating an LMS for banking and financial services on WordPress may sound complex, but with the right tools and structure, the process is straightforward. Here is a step by step approach to building a secure and professional learning platform.

Step 1: Select Reliable Hosting

Your LMS will host sensitive information and possibly thousands of learners. Choose a trusted WordPress host like DreamHost, Bluehost, Rapyd Cloud, Liquid Web, or, Web Hosting Canada. These providers offer strong data security, performance monitoring, and backups that align with compliance requirements for the financial sector.

Step 2: Install WordPress and Configure Security

Once hosting is ready, install WordPress. Add SSL certificates, firewalls, and security plugins to protect learner data. A cloud based LMS setup ensures scalability for financial organizations managing large global teams.

Step 3: Choose the Right LMS Plugin

Install a plugin that matches your training needs.

- Use LearnDash LMS for strict compliance tracking, audit trails, and advanced reporting.

- Choose Academy LMS Pro if your priority is creating engaging learning experiences for customer educationand service training.

Step 4: Create Courses and Learning Paths

Design courses based on your training programs. For example, build modules on regulatory laws, risk management, or digital banking. With built in authoring tools, you can add interactive quizzes, assessments, and certificates to support both regulatory training and financial training.

Step 5: Configure User Roles and Access Control

Set up role based access control so managers, trainers, and learners have access only to what they need. This ensures smooth administration and prevents costly mistakes in the training process.

Step 6: Enable Reporting and Performance Management

Activate comprehensive reporting features to track progress. With real time data, managers can spot gaps, monitor completion rates, and ensure compliance training is on schedule. This helps with audits and internal performance management.

Step 7: Customize Design and Branding

Apply your bank’s branding, colors, and visual identity to the LMS. Add trust elements like compliance badges and certifications. A clean, professional look builds credibility among learners.

Step 8: Test and Launch

Run test courses to ensure smooth navigation, mobile compatibility, and automated notifications. Once everything works perfectly, launch your financial services LMS and onboard employees and customers.

By following this structured approach, any financial institution can create a secure, scalable, and good LMS platformon WordPress that supports both internal staff training and external client education.

How Seahawk Can Help You Build a Financial LMS

At Seahawk, we specialize in creating secure and scalable LMS solutions for banking and financial services using WordPress. Our team has deep expertise in designing professional learning platforms that meet strict compliance requirements while delivering engaging experiences for both employees and customers. From user friendly course design to compliance ready hosting, we ensure every element of your LMS is built for performance, security, and growth.

Looking to build your own banking LMS? Start Your Project with Seahawk!

Final Thoughts

The banking and finance industry faces unique challenges when it comes to training programs and regulatory compliance. A well designed LMS for banking not only ensures employees stay compliant but also helps financial institutions deliver engaging learning experiences that improve performance and reduce costly mistakes. With WordPress and powerful plugins like LearnDash LMS and Academy LMS Pro, banks can create secure, scalable, and customizable learning platforms tailored to their exact needs.

Investing in a strong financial LMS is more than a technology upgrade. It is a commitment to compliance, employee growth, and customer trust.

FAQs: LMS for Banking & Financial Services

What is an LMS for banking and financial services?

An LMS for banking is a learning management system designed to deliver compliance training, employee training, and customer education within the financial sector. It ensures that staff and clients stay informed on regulations, financial products, and security practices.

Why should banks use WordPress for an LMS?

WordPress offers flexibility, scalability, and strong plugin support. With tools like LearnDash LMS and Academy LMS Pro, banks can build customizable, secure learning platforms that meet strict compliance requirements while providing engaging learning experiences.

Which LMS plugin is better for financial institutions: LearnDash or Academy LMS Pro?

Both are effective but serve different goals. LearnDash LMS is ideal for strict regulatory training and compliance tracking, while Academy LMS Pro works best for interactive courses and customer education.

How does an LMS improve compliance in the banking sector?

An LMS provides compliance tracking, automated notifications, audit trails, and advanced reporting. This makes it easier for financial organizations to prove regulatory readiness, reduce risks, and keep bank employees updated on the latest requirements.